In a stellar career which has seen him involved in leadership roles at companies all over the world, from Northern America and Latin America to Africa and Southeast Asia, the current leg of Elmer “Jojo” Malolos’ journey marked his return to the Philippines, where he would take charge of not one, but two companies in the Gokongwei Group.

A year ago, in August 2019, Jojo was announced as the new president and CEO of JG Digital Equity Ventures, the company billed as the group’s next-generation digital business and venture investment arm focusing on Southeast Asia, and president and CEO of Data Analytics Ventures, Inc., which aims to use data analytics to “incubate and launch new and relevant digital businesses that will enhance the lives of the Filipino consumer.”

At the time of the appointment, Jojo’s mandate for JGDEV was to develop, support, and invest in the Gokongwei Group’s next generation of digital businesses; and for DAVI, to build a leading digital rewards program and create a robust data infrastructure and analytics business which will empower other consumer-oriented digital businesses of the group.

As expected, life has been quite hectic for Jojo since taking the reins. “The past year has been really exciting and interesting, and we can say that we have been consistently progressive in our thinking, in terms of coming up with something that can be well-differentiated in the market. So it’s been an exciting year so far,” says the 57-year-old fintech veteran.

At DAVI, he first wants to clear up the misconception that the company is merely a customer rewards program. While a large part of its business consists of managing the rewards programs of Cebu Pacific (GetGo) and Robinsons Retail Holdings, Inc. (Robinsons Rewards), Jojo clarifies that DAVI, as its name suggests, is a data analytics company. He explains, “We are a repository of all the [consumer] data in the group. And our mandate is how can we monetize it, create new businesses out of it, create new business models, that will disrupt the market and create high growth businesses.”

For JGDEV, he set out to ensure that the US$50 million fund that has been earmarked for investments in startups within the region can provide long-term benefits for the JG Summit Holdings ecosystem and not just quick investment gains.

Putting his venture capitalist cap on, Jojo explains there are many ways that the fund can be used. The first is by investing in other funds, piggybacking on their experience and past success. “You can invest in another funding company, such as Wavemaker Partners (wavemaker.vc) for example, that is looking for startups and then you place your bet on them.”

Another method is to invest in the startup company directly. Jojo explains that this is the route JGDEV prefers to take, with a set of criteria in mind. “We’re looking at investments that are between $1 million to $5 million, and either in Series A or Series B,” he says, referring to the early stages of company funding and product development. The resilience of a potential investment will also be studied, and now, thanks to the Covid-19 situation, preference will be given to companies involved in fintech or e-commerce.

As he alluded to earlier, the potential return on investment is weighed in the decision, but more emphasis is placed on the impact the investment will have down the line. “It’s okay if I get my $50 million fund to become, say, $55 million or $60 milion after eight years. But the impact of that $50 million through investments in other companies and their impact on the JG Summit group will be the bigger metric.”

Jojo mentions Zyllem, one of the companies that JGDev had invested in before his appointment, to further expound on this strategy. “Zyllem is a logistics supply chain platform that basically allows you to have one single control tower taking a look at your third-party logistics partners,” says Jojo. “If you use them, they will take care of logistics, dispatch, scheduling—depending on what you want. They will save you money, but more important, you will come up with a logistics process that is very ‘control towered’ and very systematic using their technology. We’re getting them to be involved in The Generics Pharmacy, in parts of URC, and also in Ministop.”

Jojo continues, “If our initial investment in Zyllem—let’s say it was 2 million, and then it doubled after eight years, that would be great. But the more important aspect would be, that since we started using Zyllem in URC and they were able to save millions of pesos, and then we were able to use it in TGP, allowing them to expand their base, that is more important for us.”

LEADING BY LETTING GO

As the head of two companies, Jojo says that the most important aspect of the job is communicating very clearly to his teams the vision he has for the businesses. “In a digital and disruptive environment, my role as a CEO is to make clear, in the biggest possible way, our direction.”

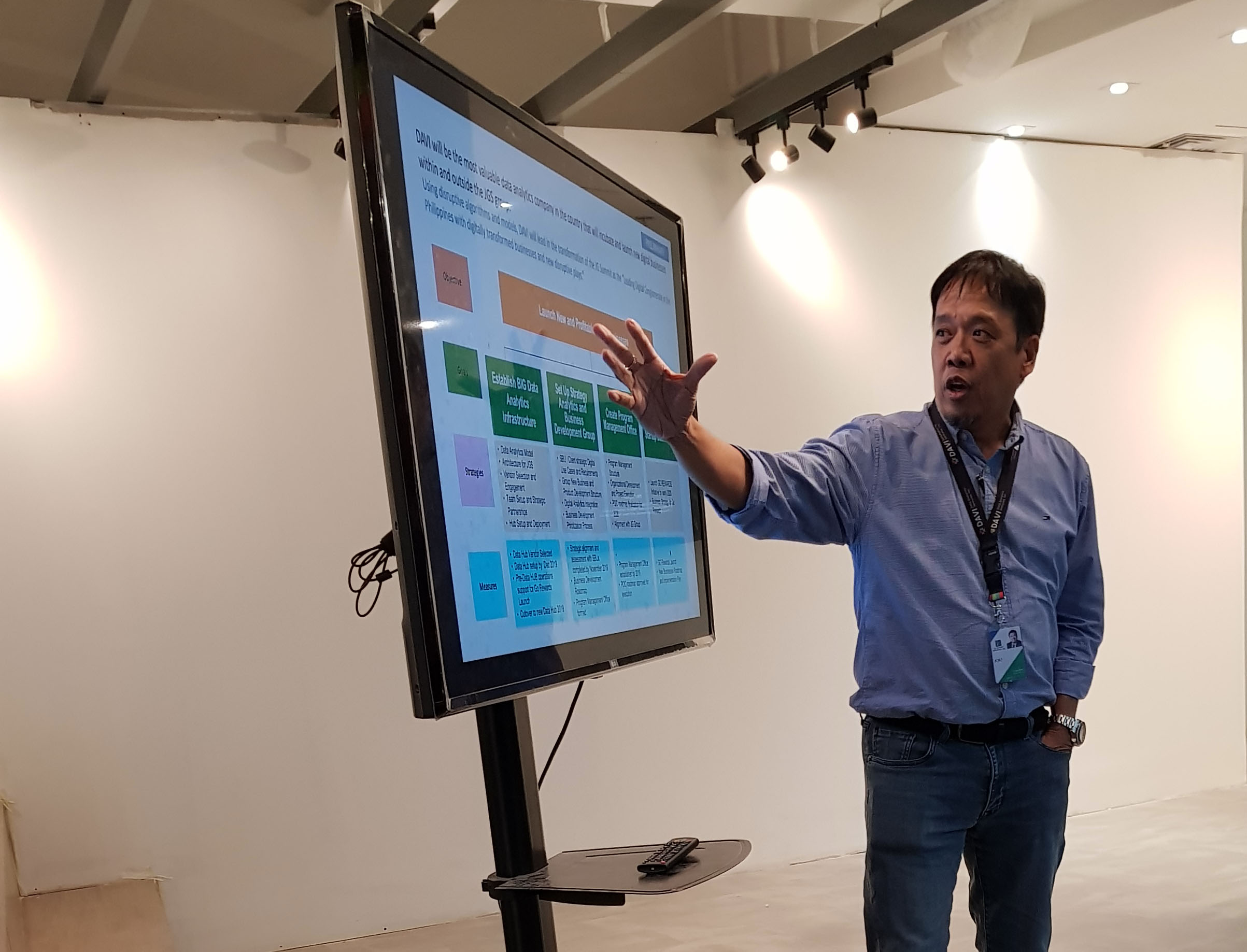

For DAVI, the direction he set is that it will become the most valuable data analytics company in the country. “I have to get that in the minds of my team leaders. The leaders, the heads, will handle the technical issues. They are the data scientists, the marketing guys, the entrepreneurs, who, based on that direction, will craft something. Out of the data that we have, we have to analyze how can we develop businesses. With this data, what will be our parameters towards monetizing and creating opportunities by which RRHI and other businesses in the group really find value in us.”

One fascinating aspect of DAVI’s business is the way it will allow the companies that use their data to focus their marketing or advertising efforts on the right demographic, market, or customer. “When you advertise on TV, in Out of Home media, or print, you don't know whether people are really buying or not because of that ad, right? But when companies use our data, and they give us a portion of their advertising spend [budget], we are certain that we’ll be able to make them see that there’s an equivalent sales attribution for that. That is very disruptive. If we are able to do that, we will be able to disrupt the entire advertising industry,” claims Jojo.

For JGDEV, he wants to communicate the “bigger picture” acquisition strategy that will have great impact on the conglomerate. In Jojo’s view, the Gokongwei Group has the biggest ecosystem in the country, involved in the airline industry, retail, food manufacturing, petrochemicals, media, banking and finance, and a host of other investments. “I don’t think any other conglomerate is as expansive as that,” says Jojo, and so “the bigger picture, the bigger impact,” strategy will continue to drive business decisions moving forward.

Once Jojo sets the direction for his two companies, ensuring that his teams are pushing toward the same goals, he lets go and allows them to do their thing. Of course, before they earn his trust, he makes sure they are capable of doing the task at hand. He builds his own confidence in his team through the value of stewardship, where he shares the experience, knowledge, and learning accumulated in his long career. “My style is to make sure that there is a passing on of knowledge,” says Jojo.

With his guidance and vision for the company imparted to his team, he trusts that they can perform up to expectations without having to constantly look over their shoulders. “I am not a micromanager,” he declares. “I take a risk by giving people certain levels of responsibilities that they can learn from to move forward with. I take a risk by getting a finance person to become the head of an operations team. I take a risk in getting someone in HR to become potentially the new CEO of a company. Because yun nga, I’ve been able to cascade down certain learnings they are able to appreciate. I tend to empower my team, I allow them to make mistakes. I allow them to make decisions that are beyond their comfort level.”

TAKING A LEFT TURN

Perhaps this trust in people comes from Jojo’s own experience over the course of his multi-faceted career, when key people also placed their faith in him.

One of the critical pivots in Jojo’s life was when he abruptly shifted professions, from being a civil engineer to working as a management consultant. After his graduation from the University of the Philippines, Jojo built a solid career as a civil engineer and worked with some of the top construction firms in the country. However, there was an itch he couldn’t keep scratching, the urge to expand his horizons. While he was working, he found time to complete his MBA also at UP, which got him interested in concepts like management reengineering, enterprise quality management, and finance.

At around the same time, a friend of his, Lenard Berba, was forming a new consulting company and offered Jojo a job as a consultant. “I took that bait and luckily it paid off,” says Jojo, reflecting on the fulfillment brought about by his change of profession.

Many years later, Jojo would find himself earning the confidence of another man whom he considers a mentor, Napoleon Nazareno, a former president and CEO of PLDT. “When he got his job as the CEO of both Smart Communications and PLDT, he asked me to help him facilitate the merger. It was basically the two of us who designed the corporate strategy,” Jojo reminisces.

By the 2010s, Jojo had become a staunch advocate for financial inclusion, and he credits Carol Realini, an expert in financial service innovation, with leading him down this path. “This lady is a serial entrepreneur of Silicon Valley, but very soft spoken,” says Jojo. He remembers that Realini provided tremendous support when he moved for brief period to the United States, and also helped him develop his vision for financial inclusion.

BIG PLANS BACK HOME

Providing financial services for the unbanked became Jojo’s expertise in recent years, which eventually saw him being brought in as CEO for Wing Limited Specialised Bank, one of the biggest fintech companies in South East Asia. Wing pioneered mobile finance in Cambodia, helping bring financial inclusion to the country’s large unbanked population.

Now that Jojo is back in the Philippines, he brings big plans and dreams to his role in JGDEV and DAVI.

With the interview drawing to a close, Jojo reiterated his goal to make JGDEV the most prestigious venture capital firm in the country, where “the industry will recognize us as a fund that is maximized by the fact that we’re able to accelerate the success of startups by using the JG Summit ecosystem as the base of a product. Meaning, if you’re a startup looking for customers, looking for contracts, you do it here. We will be a venture capital firm that speaks very highly of the culture of the JG Summit group.”

And for DAVI, “Being the most valuable data company in the Philippines means a lot of things. It can be valuable in that it will reflect in the success of the JG Summit Group. Also valuable in the sense that we'll be a recognized disruptor in the industry, wherein we change paradigms, we accelerate the obsolescence of some business models, and we also help prove to everybody that this is the ‘new normal.’ The new normal is all about data.”

For more information on JG Digital Equity Ventures, visit jgdev.ph

For more information on Data Analytics Ventures, visit davi.com.ph