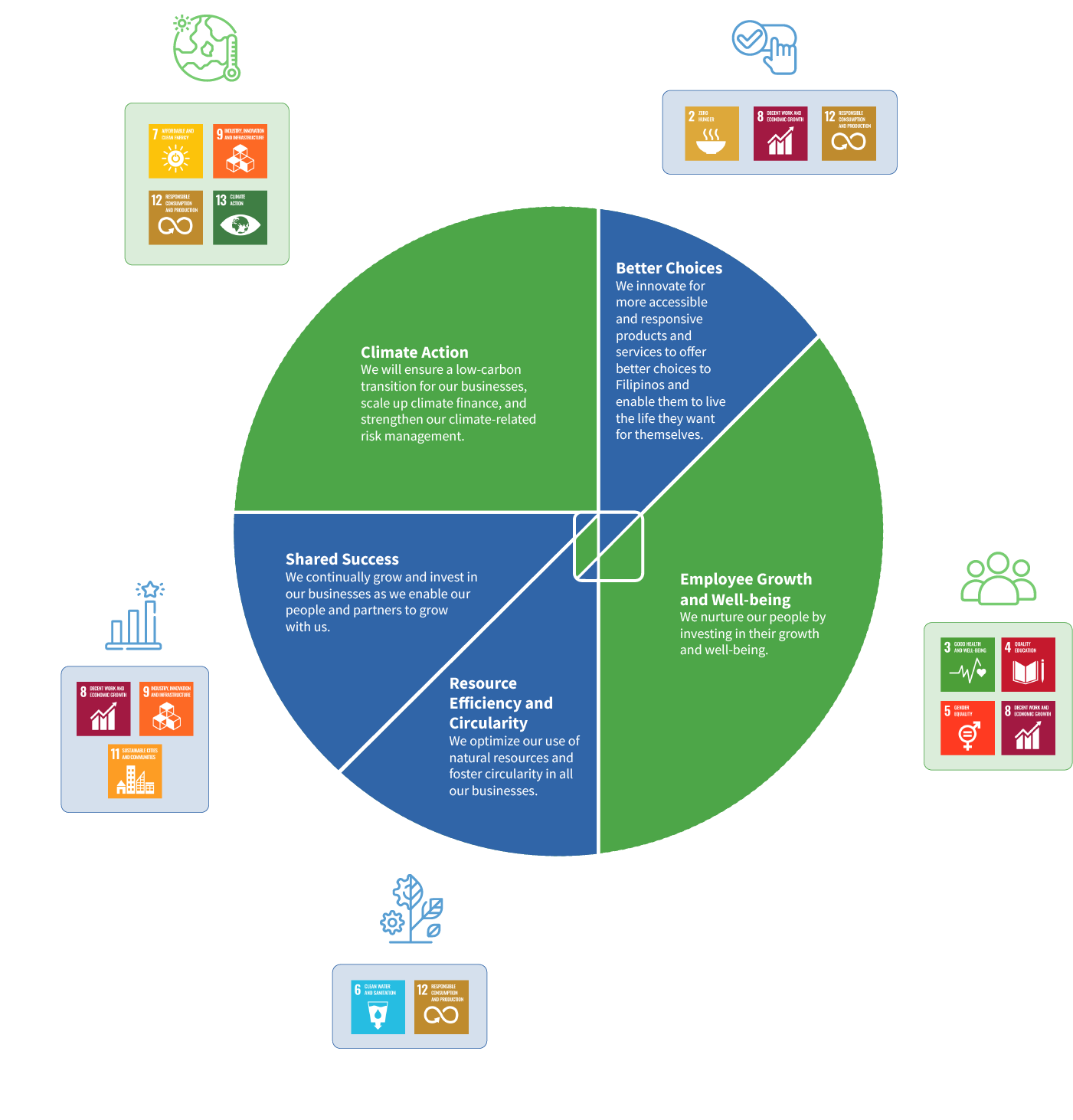

Our brands are built on the trust and loyalty of our customers. This relationship is further nurtured by our rigor to keep offering them high quality, affordable, and accessible products and services.

Php 98 Million

investment (in Giga Tower) to meet international green building standards

70,000

New RBank Simplé Savings Accounts opened

JGS is one with the Filipino people in upholding the bayanihan spirit. We acknowledge our company’s role in providing the needs and support to the communities that we work with.

Pandemic Response

- 1,410 sweeper flights for OFWs and stranded local individuals, with Php 39 million free cargo space for essential and relief goods

- 67 million COVID-19 vaccine doses transported nationwide

- 1.98 million people vaccinated for COVID-19 in 37 malls

- 65,000 COVID-19 vaccine doses donated to the national government and 11,000 doses to local government units via the Gokongwei Brothers Foundation (GBF)

- Php 12.5 million worth of alcohol, medical kits, and other items donated by both local and international URC operations to medical workers, COVID-19 patients, and essential workers

- Php 6 million worth of food packs, medical, school and livelihood supplies donated to the residents and workers of JGSOC’s host communities

- Php 1.8 million worth of Christmas gifts given to 330 nurses from hospital partners and ER nurses by RBank as appreciation to the efforts during the pandemic

Supporting Education

- 46 Grade 4-6 students initially supported through the launch of JGSOC’s Juan Kapatid Tutorial Program in partnership with GBF to bridge knowledge gaps on STEM subjects and to ensure continuous learning of students even during the pandemic. The matching Suporta Eskwela Parent Club was also launched to serve as a venue for parents to learn how they can support their children in their education and for them to ultimately become advocates of learning.

- Php 50,000 donated by RBank through the “The Future is Bright” program for the GBF scholarship fund as of December 2021. RBank donates Php 0.5 for every Pesonet, Bills Payment, Remit, and QR transaction done through the RBank Digital Platform. The program runs from November 2021 to November 2022, in time for RBank’s 25th anniversary.

- Two schools (Tanza National High School and Molino Elementary School) were given supplies, such as alcohol, face masks, reams of bond paper, and printers with ink under RBank and GBF’s GBF Brigada Eskwela Project.

Case Studies: Better Choices

URC: Providing Good Food Choices for All

The past two years living with the pandemic reaffirmed the importance of maintaining a healthy lifestyle and boosting our immunity against diseases. As a food manufacturing company that carries brands that are patronized and loved by Filipinos, URC recognizes the opportunity to promote healthier food choices for all.

Since 2019, URC has been working on improving the nutritional quality of its product portfolio. The company has been monitoring its progress in doing so through the Wellness Criteria. By the end of 2021, 99% of all URC products have passed one URC criterion, 71% have passed two, while 36% have passed three. Through its rigorous product research and development, URC will continue to improve these numbers in the coming years.

URC has also implemented product portfolio changes in the past year. This includes a shift to non-PHO (partially hydrogenated oils) formulations for some of its snack and candy brands, such as Nips, Wiggles, Chooey Toffee, Cloud 9, and Wafrets. PHOs, or more commonly known as trans-fat, contribute to the increase of “bad” cholesterol in our bodies which may lead to heart diseases⁴. URC targets to eliminate the use of PHOs by 2022.

Aside from PHOs, sugar is another ingredient that could potentially lead to cardiovascular diseases. In 2021, URC worked on the reformulation of its beverage brands, Blend 45, C2, and Refresh, to lower its added sugar content to 6%.

Meanwhile, other snack and beverage products were fortified with vitamins and minerals. This includes C2 Immuno, B’lue Vita Boost, and Maxx Vitamin C candy which are sources of Vitamin C that help contribute to the normal function of the immune system, and Presto Creams Peanut Butter, which is a source of B vitamins that help you focus.

In line with JGS’ commitment to provide Better Choices to Filipinos, URC continues to uphold its purpose to delight everyone with good food choices.

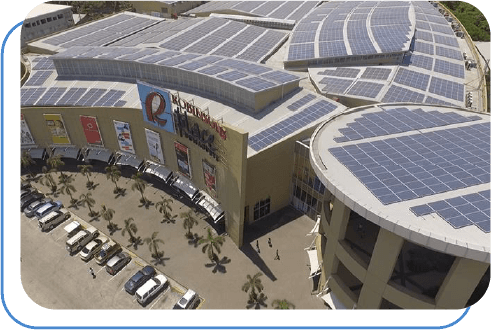

RLC: Offering Greener Office Spaces

While we at JGS are already taking steps internally towards heightening operational efficiency efforts, we also want to provide our business partners with the opportunity to also contribute to lessening our negative impacts on the environment. Our real estate arm, RLC, does this by providing its tenants with greener choices when it comes to their office spaces.

As one of the leading real estate companies in the country, RLC continues to innovate its designs, and in the process, integrate sustainability in it. Giga Tower, RLC’s newest office building, is LEED Gold-certified for Building Design and Construction (LEED BD+C), meeting world-class standards in design, construction, and operational efficiency. It is designed to consume 9.5% less electricity overall compared to the same design with standard features.

Advanced meters per energy source per floor were also installed in the project, allowing the tenants to measure the consumption for all systems dedicated to their space and adjust their operations as they see fit. This enables tenants to be more mindful about their consumption of electricity and water, and in the long run, gain cost savings from their operational expenses.

CEB: Enabling Every Juan to Fly Anywhere at Low Costs

Cebu Pacific is the largest carrier in the Philippine air transportation industry, offering low-cost services to more destinations and routes with higher flight frequency within the country than any other airline. While we contribute to ensuring that the planet remains viable for the future generations to come through our purchase of more fuel-efficient planes, we also prioritize providing inclusive, affordable, and accessible air travel to Filipinos.

CEB opened 2021 with 40 domestic and 24 international destinations, spanning Asia, Australia, and the Middle East. As imposition of strict travel restrictions continued, Cebu Pacific ended 2021 with 47 domestic and 15 international destinations. With 74 aircraft in service, the airline transported a total of 3,411,396 passengers, gaining 48.50% of the domestic passenger market share and is the leading airline against key competitors in the air travel industry.

In the same year, CEB launched the CEB Super Pass (CSP) as its innovative and insightful response to the air travel challenges brought about by the pandemic. Through the CSP, customers can buy all the travel passes they can and fly when they can within one year to domestic destinations in CEB’s widest Philippine network. The CSP is priced at a competitive price of Php 99 one-way base fare per pass.

CSP continues to improve its sales performance and gain relevance since it was launched. It garnered a success rate of 43% in May 2021 and 84% in September 2021. As travel activities begin to increase once again, we see an upward trajectory for CSP.

CEB has also hosted the CEB Super Seat Fest (SSF) for the past four years. Based on CEB’s latest Alida Survey, “affordability” moved up as part of the Top 3 of travel considerations, along with Travel Requirements and Restrictions; hence, SSF has thrived amidst challenging and pressing passenger concerns. This was reflected in the record-breaking success rates during the back-to-back SSF and CEB Super Pass (CSP) sales from September to December 2021, which generated notable spikes in conversion month-to-month. The month-long Php 88 sale has performed well alongside two major offers - Piso and CEB Super Pass - indicating higher-than-ever travel and low fare demand of which CEB continues to make accessible for everyone.