We are delighted to share with you our solid 2019 performance. Coming from a very challenging 2018, we saw a strong recovery as JG Summit (JGS) posted significant profit expansion for the period.

JGS’ overall topline increased by 3% year-on-year (YoY) to Php301.8 billion for the full year ended December 2019 driven by: (1) robust passenger volumes, better yields and higher ancillary revenues in our airline business, (2) wider net interest margins (NIM) and trading gains in our banking unit; as well as (3) our Php3.0 billion share in United Industrial Corporation Limited’s (UIC) gain arising from its acquisition of additional shares in Marina Centre Holdings and Marina Mandarin Hotel. These were tempered by slower growth in our international branded consumer foods (BCF) and agro-industrial and commodities (AIC) divisions; as well as lower sales volume and average selling prices in our petrochemicals business.

Core net income after tax amounted to Php25.3 billion, up 13% YoY due to margin improvements in our airline, banking and food subsidiaries. Including the impact of mark-to-market and forex gains totaling Php1.5 billion, plus our share in UIC’s gain on acquisition and JG Summit Petrochemical Group’s (JGSPG) impairment loss reversal, net income grew faster at 63% YoY to Php31.3 billion in 2019.

JGS’ balance sheet as of end-December 2019 remains healthy with gearing and net debt-to-equity ratios at 0.67 and 0.52, respectively. At the Parent level, net debt amounted to Php76.0 billion after settling Php24.5 billion of maturing debt last August 2019 through a combination of cash, short term and long term debts. With this, the blended cost of the parent’s long-term debts stood at 4.7% with an average remaining term of 3.3 years. Furthermore, we continue to receive stable stream of dividends which totaled Php16.5 billion mainly coming from Universal Robina Corporation (URC), Manila Electric Company (MER), and Cebu Air Inc. (CEB). Lastly, the group had Php72.1 billion of capital expenditures in 2019 with majority being spent for CEB’s aircraft acquisitions, aircraft engine and various non-flight equipment, as well as JGSPG’s expansion projects.

On URC, our transformation initiatives on better supply fulfillment and wider distribution coverage in BCF Philippines have started to generate encouraging results across all our categories. These programs, together with higher flour volumes and the strong Animal Nutrition & Health (ANH) performance in AIC, drove URC’s revenues to Php134.2 billion, a 5% growth YoY. This was moderated by softer results in our Thailand, Oceania and Vietnam markets. The transformation projects in our domestic BCF business and the recovery in Vietnam likewise resulted in better operating margins. Hence, URC’s net income grew by 6% YoY to Php9.8 billion.

URC continues to reinvest in brand building and distribution in its Branded Consumer Foods (BCF) Philippines to strengthen its brand portfolio and sustain its robust topline growth. Our key strategies are focused on growing the core and expanding for more. On growing the core, we have pushed for strong trade executions with proactive advertising across all channels and regions to support product launches. In expanding for more, we continue to develop products based on the latest global consumer trends on new flavors and formats across the region. In line with this, URC has rolled out the new innovation process management across its business units which requires a more in-depth understanding of consumer insights as input to brand renovation and new product launches. Some of the successful launches in 2019 were the two new white coffee variants namely Great Taste White Caramel and Great Taste White Crema, as well as the reinvigorated version of the original Great Taste White. Lastly, we also announced our long-term sustainability commitments in line with the United Nations Sustainability Goals objectives on Natural Resources (energy and water), People (employees, communities) and Products.

On CEB, the sustained double-digit growth in passenger volume, higher average fares, and increased ancillary revenue per passenger, boosted its revenues by 14% YoY to Php84.8 billion in 2019. We saw a significant recovery in CEB’s net income, which surged 133% to Php9.1 billion in 2019, driven by effective cost management, deployment of larger and more fuel-efficient planes, coupled with favorable oil and currency environment for the year.

CEB’s operations remain to be solid with on-time performance ending the year at 71% and seat load factor at 86%. We continue to protect our stronghold in Manila airport while adding new routes in Clark and making Cebu a transit hub to other islands in the country. To accelerate the replacement of our existing A320 and A330 CEOs in to a more fuel-efficient and more eco-friendly fleet, we have signed a purchase agreement with Airbus SAS for the order of 16 A330-900 aircrafts. Furthermore, given our strategy to expand our Cargo business, we have converted two Cebgo ATR 72-500s into cargo planes with our first ATR freighter beginning operations in September 2019. Lastly, given our exposure to fuel prices and foreign exchange rates, we have implemented a more active treasury risk management to mitigate its impact to our profitability.

RLC also delivered strong results with revenues ending the year at Php30.2 billion, a 3% increase vs SPLY. We saw stable growth & cinema ticket sales in our existing malls, rental escalation & higher renewal rates in our previously built offices, better occupancy rates in our current hotels, plus fresh contribution from our newly opened properties. All these resulted in double-digit topline growth across our investments portfolio. In addition, there was strong demand for residential units from both local and foreign buyers. However, our Industrial and Integrated Developments (IID) division experienced a decline from a higher base last year, when we booked revenues from the sale of land to our joint venture with Shang Properties, Inc. RLC’s net income rose 6% YoY to Php8.7 billion in 2019, slightly ahead of revenue growth despite higher depreciation expense mainly from newly opened hotels, and higher interest expense.

On our Commercial Centers Divisions, we successfully opened our 52nd mall named Robinsons Galleria South which is San Pedro, Laguna’s first world-class full service mall. We also opened the first phase of the expansion of our Robinsons Starmills mall in Pampanga, and began the construction of two new malls and two mall expansions that will come online in 2020. On our Offices division, we have geared up for the completion of three new offices namely Cybergate Magnolia, Giga Tower, and our second build-to-suit office development in Luisita, Tarlac. On our Hotels & Resorts division, we have opened Dusit Thani Mactan Cebu Resort, our five-star luxury resort located on Mactan Island in Cebu; and Summit Hotel Greenhills in San Juan City which is easily accessible by business and leisure travelers in the Metro. On our Residential division, we launched the first of the four towers of Sync Residences which caters to young professionals and early nesters. In addition, we have officially launched Aurelia Residences in partnership with Shang Properties which is our foray to premium condominiums. On our China business, we have successfully sold 100% of the condominium units in Cheng Du, China for the phase 1 project. And on our mixed-use developments, we have officially unveiled our first destination estate named Bridgetowne, which will have residential units, BPO & Grade-A office buildings, a lifestyle center and a five-star hotel.

Moving to JGSPG, its revenues declined by 31% YoY to Php29.1 billion in FY19. The weakened market conditions brought about by protracted US-China trade tensions and the overall slowdown in the global economy, has led to tepid petrochemicals demand causing our volumes and average selling prices to drop. We also had lower utilization rates considering the entire complex was shut down for a scheduled turnaround maintenance in 4Q19, which we also used as an opportunity to execute project tie-in activities related to our capacity and downstream expansion plans. Full year EBITDA declined by 84% YoY to Php538.7 million as average selling prices fell faster than raw material costs. However, anticipating better EBITDA generation capability after the completion of the turnaround maintenance and the expansion projects, we reversed an impairment loss booked in 2004, when JGSPG’s operations were only limited to polymer plants. This more than offset higher financing costs, leading JGSPG to end 2019 with a net income of Php970.6 million.

JGSPG has successfully executed the bulk of its expansion projects in 2019. This expansion will allow us to move further downstream with new derivatives namely Butadiene and Raffinate-1 from Mixed C4, as well as Benzene, Toluene and Mixed Xylenes from Pygas. In addition, from basic polymers, we can diversify into valueadded polymers with our polypropylene expansion and new bimodal polyethylene plant by 2020. Since 2019 was a scheduled turnaround maintenance year where the entire complex shuts down for two months, we have implemented reliability initiatives to maximize run rates as well as expansion product tie-ins. The organization has also been preparing for the expanded operations and upcoming products in preparation for the commissioning of the developments in 2020.

Lastly, RBank’s revenues totaled Php8.1 billion, a 32% increase YoY on the back of a 17% loan portfolio expansion, mostly led by consumer loans. In addition, we booked a substantial trading gains from treasury business activities for the period. Net income rose faster at 126% growth to Php719.4 million as NIMs continue to widen. The shift towards consumer loans lifted average loan yields while favorable policies from the central bank helped manage funding costs.

RBank was awarded as the fastest growing commercial bank in the Philippines by the Global Business Outlook Awards, and the best commercial bank in the Philippines by the International Banker 2019 Banking Awards in recognition of the bank’s significant expansion as well as its introduction of innovative products in the market. We have strengthened our cards business by increasing the number of users, frequency and utilization through digital marketing initiatives and merchant acquisitions, among others. We also introduced “Iponsurance” which is an insurance bundle with high life insurance coverage and low maintaining balance. Furthermore, we continue to expand our branch network to widen our reach. We launched three hybrid branches which incorporate traditional banking with digital banking platforms to simplify the customer journey. Meanwhile, we have diversified our funding sources in 2019 to support our growth. We issued a Php5.0 billion two-year corporate bond last August 2019 which was 4x oversubscribed, and raised another Php5.0 billion in Nov 2019 to complete our Php10.0-billion bond program.

In addition to the robust performances of most of our businesses, we have strengthened JGS’ role as a parent with our enterprise transformation initiatives which commenced in 2019. Our transformation journey will be discussed in the succeeding sections.

In 2019, we also lost our founder, Mr. John Gokongwei, Jr., who, along with his brothers, built the foundation of JGS and brought the company to where it is today. Through his vision, the company has significantly expanded its portfolio, and has become one of the largest and most diversified conglomerates in the Philippines. After assuming the President and Chief Executive Officer (CEO) role last May 2018, a new challenge of steering the direction for JGS under my leadership has begun. 2019 was my first full year in this role. It was the beginning of a new chapter for the group, a new route to embark on, and a new summit to conquer.

Prior to my appointment, an elaborate organizational and governance transformation journey started a few years ago to ensure continued success. We have implemented a number of organizational changes on the Strategic Business Units (SBUs) and on the parent company to shift decision-making and accountability on the growth and development of each SBU while safeguarding the group’s assets with robust risk management and internal control systems. These initiatives have allowed me to have greater focus in crafting the overall strategy of the group, maximizing synergies across the JGS ecosystem, and determining the next growth pillars of the organization.

With these strategic foundations in place, we continued the transformation journey in 2019. With a more inclusive and iterative process in crafting our longterm ambition, we began deliberating on the future of JGS. Building on the work we’ve done in the previous year when we identified key strategic thrusts for the organization, we have gathered feedback and inputs from key leaders across the group, including members of the Gokongwei family. We revisited our Purpose, Values and described the JGS Leader, all of which are foundational elements that will enable us to achieve our 5-year Ambition and Goals. We also launched a long-term strategic planning process using the Objectives, Goals, Strategies and Measures (OGSM) model allowing us to develop and document the 5-year business strategy of JGS and our subsidiaries. And lastly, we have embarked on an enterprise transformation initiative to strengthen the organizational alignment, collaboration and execution among the parent and SBUs towards a common, long-term ambition.

We recognized the need for JGS’ planning cycle to shift from a tactical annual budget and operating plan to a more long-term strategic roadmap where there is clear alignment among the Group’s ambitions, as well as the roles of the corporate center (CC) and each SBU in the portfolio. The use of the OGSM across all SBUs has allowed us to build upon the wins of our previous transformation initiatives, and has provided us a common language for strategic planning.

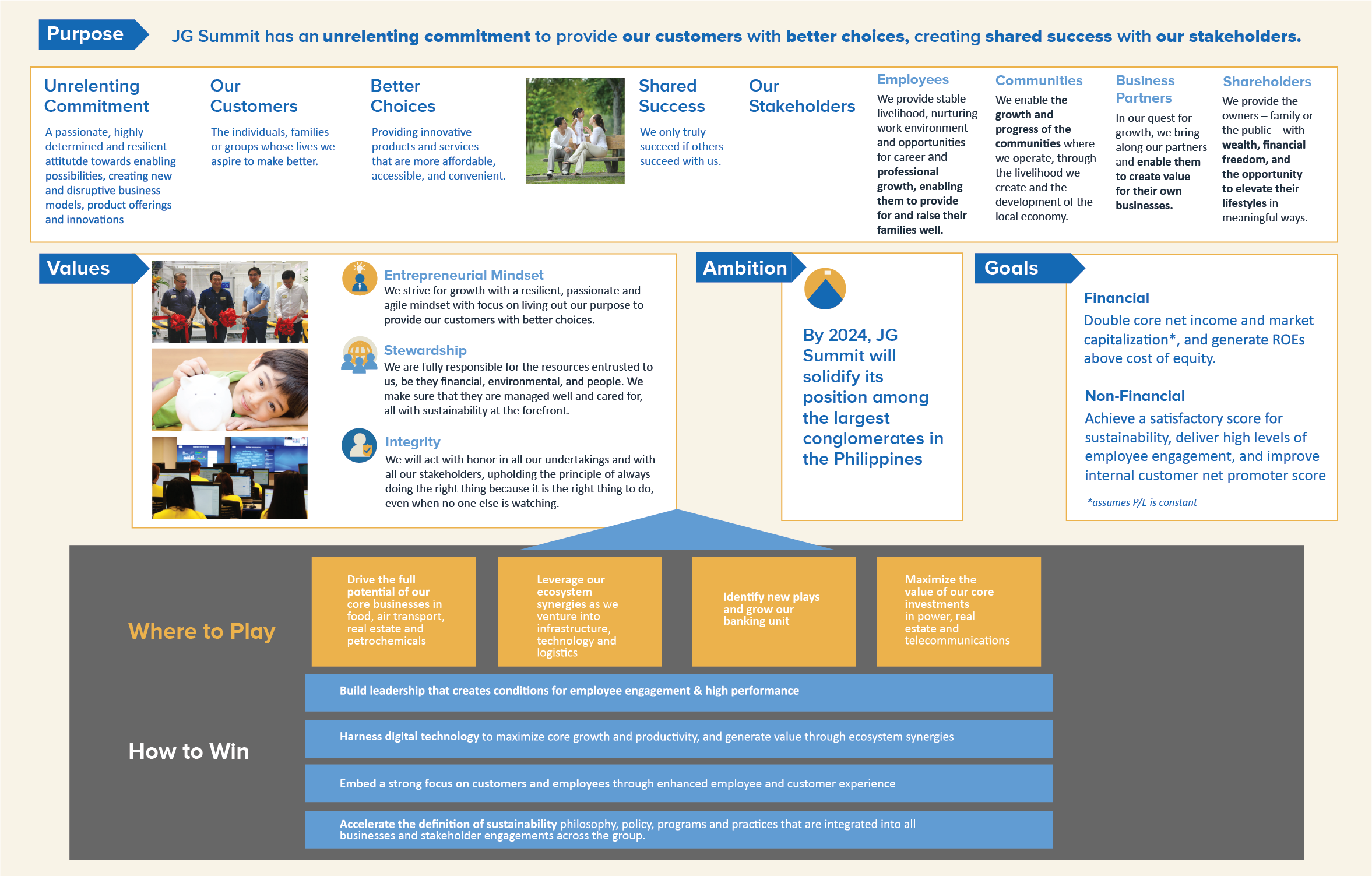

JGS’ OGSM framework begins with a purpose, an inspiring articulation of the company’s reason for being and the role it plays in the lives of its stakeholders; the vision for the next 3-5 years; the financial and non-financial goals, the strategic choices we make about where to compete, and the strategies we will employ to win. In 2019, we have redefined JGS’ purpose and values; stated our 5-year ambitions, goals, and key strategic directions; enabled the SBUs to craft their own 5-year strategies as guided by the parent company’s ambitions and their cascaded portfolio roles within the conglomerate; as well as emerged the need to revisit the parenting strategy, the role of the CC and how it can be a strong enabler for the SBUs.

Our purpose was crafted after much reflection on what has brought about the success of our company in the last 65 years, and what we see as the reason for being for this company. JG Summit’s purpose is to have an unrelenting commitment to provide our customers with better choices, creating shared success with our stakeholders. We have a passionate, highly determined and resilient attitude towards enabling possibilities, creating new and disruptive business models,

product offerings and innovations. We put our customers first, who are individuals, families or groups whose lives we aspire to make better by providing innovative products and services that are more affordable, accessible, and convenient.

We believe that we will only truly succeed if our stakeholders succeed with us. We will continue to provide stable livelihood to our employees, nurturing work environment and opportunities for career and professional growth, enabling them to provide for and raise their families well; enable the growth and progress of the communities where we operate, through the livelihood we create and the development of the local economy; bring along our business partners and enable them to create value for their own businesses; and provide our shareholders with wealth, financial freedom, and the opportunity to elevate their lifestyles in meaningful ways.

With our purpose in mind, we have set our ambition and goals in the next five years. Our vision is to solidify JG Summit’s position among the largest conglomerates in the Philippines. We will deliver this through a strong entrepreneurial mindset acting with agility, courage and grit. We will act with stewardship having a long-term strategic view, always acting with integrity, respect and humility.

Our 5-year goals are a mix of financial and non-financial targets which include doubling core net income and market capitalization, generating a Return-on-Equity (ROE) above cost of equity, achieving a satisfactory score for sustainability, delivering high levels of employee engagement, and improving internal customer net promoter score.

To realize our long-term ambition and targets, it is imperative that we make deliberate and disciplined choices on where to compete and define a clear portfolio strategy. We will drive the full potential of our core businesses in food, air transport, real estate and petrochemicals, leverage our ecosystem synergies as we venture into infrastructure, technology and logistics, identify new plays and grow our banking unit, and maximize the value of our core investments in power, real estate and telecommunications. We will make these happen by building a leadership that creates conditions for employee engagement and high performance; harnessing digital technology to maximize core growth and productivity, and generate value through ecosystem synergies; embedding a strong focus on customers and employees through enhanced employee and customer experience; and accelerating the definition of sustainability philosophy, policy, programs and practices that are integrated into all businesses and stakeholder engagements across the group.

After we established the total corporate strategy, we have worked on determining the right parenting strategy and consequently the role and structure of the center as well as the right governance model. Based on the OGSMs presented by our subsidiaries, we believe that JGS can add more value to the group by driving cross-BU synergies though scalable cost and expenses, possible revenue synergies and sharing of data and talent; making available new, unique, and expensive competencies across the organization; providing access to capital markets and resourcing; and challenging business strategies and financial targets through healthy dialogues. With these, we have defined our key parenting roles which include providing strategic guidance and allocating capital to our subsidiaries and new investments; developing our leadership and succession plans, and ensuring portability of talents within the organization; and managing the conglomerate’s reputation which encompasses our groupwide sustainability strategy.

We will make sure that JGS and its subsidiaries’ ambitions happen by embarking on an enterprise transformation initiative. Our approach to

transformation spans the delivery of our Purpose and 5-year OGSM, the development of leaders who will bring us to our desired destination, the demonstration of our core values of Integrity, Stewardship and Entrepreneurial Spirit, and the commitment to support and enable individual and personal change.

2019 has truly been a turning point for JG Summit with all the transformation initiatives to bring JGS to the next summit. However, with the coronavirus disease becoming a global pandemic early in 2020, we believe that we are now living in a very extraordinary period where communities’ lives and businesses have been heavily disrupted. While we cannot predict the future, it is incumbent upon all of us to start assessing, and more importantly, preparing for the most plausible scenarios we might face moving forward. I, together with Mr. James and our SBU and CCU leaders, have put scenario planning and business continuity plan on top of our agenda. In the midst of all the uncertainty around us, one thing I know is certain: JGS will rise up to the challenge as we have always done so, and that we will be able to weather this passing storm together.

I would like to take this opportunity to thank all our stakeholders- our shareholders, our board of directors, and our customers for your continued trust and support in the organization. To my colleagues in JGS, there is no better group of people that I would like to be working with me, to be by my side in these challenging times. I hope that all of you will continue to accompany us in this new and remarkable journey in the succeeding years. You are the reason that makes me supremely confident that we will only emerge stronger, more united, and more prepared to forge ahead.