Robinsons Bank Corporation (RBank), the financial services arm of the JG Summit Group of companies, is one of the fastest growing commercial banks in the Philippines in terms of capitalization and asset size. Being a full-service commercial bank, it delivers hallmark value and convenience to its customers, business partners, and the general public through a wide array of innovative products and services.

2018 Financial Performance and Key Developments

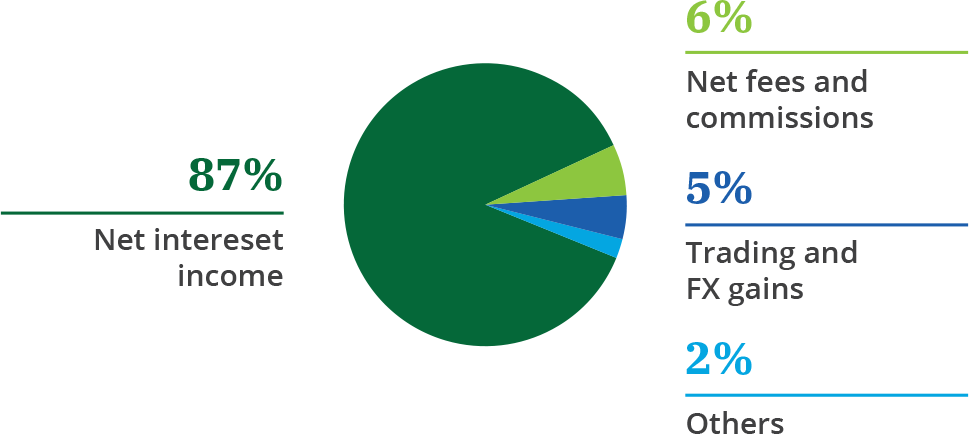

RBank’s financial performance for 2018 remains above the industry. The Bank’s total assets stood at Php121.4 billion at end-2018, which is 16% higher vs end-2017, ahead of the industry’s 12% growth. This expansion was driven mainly by the 18% increase in the gross loans to Php68.3 billion from Php57.8 billion a year ago. The sustained growth of the lending activities was due to the surge in the consumer lending, which rose 41% to Php22.9 billion this year. Total deposits modestly went up by 6% to Php95.0 billion, with CASA deposits expanding by 19%. As a result, net interest income improved by 20% to Php3.6 billion.

Moreover, RBank’s sound credit underwriting standards resulted to a very healthy loan portfolio quality. Despite the growth in loan volume, the non-performing loans (NPLs) dropped to Php890.0 million in 2018 from Php1.1 billion in 2017. The Bank’s gross NPL ratio was at 1.3%, while the net NPL ratio was at 0.8%. These ratios are healthier than the industry’s 1.8% and 0.9%, respectively. The Bank has adequate cover for defaults at 123%, an improvement from 2017’s NPL cover at 101%.

The non-interest income contributed Php533.4 million, 12% higher vs last year, buoyed by fee-based income. The decline in trading gain was due to a challenging market condition, but was compensated by the forex gains amounting to Php174.4 million.

These banking activities resulted in RBank’s net income of Php317.1 million, a 3% growth from last year’s Php307.4 million. This was impacted by the surge in interest expense, due to the rising interest rate condition in 2018.

Major Transformation Initiatives

In 2015, RBank embarked on its five-year strategic plan, the Roadmap 2020, which has three phases: Capacity Building, Core Income Growth, and Entry into Cards Business. In line with this, the Bank has rolled out a number of initiatives in 2018.

RBank began 2018 by announcing the establishment of a strategic bancassurance partnership with Pru Life UK. In May, the Bank introduced the Direct2Bank PesoNet, which allows quick and easy fund transfers from an RBank account to another bank account within the Philippines. Direct2Bank InstaPay was also offered later in 2018 to facilitate the transfer of funds to the beneficiary’s Bank account instantly.

As part of RBank’s commitment to provide financial flexibility to its customers, it officially launched the Robinsons Bank Credit Card in May 2018. With the Robinsons Bank DOS® Mastercard, cardholders can extend their finances for all their straight retail purchases in 2-Gives with no minimum amount required. To complement its card business, RBank has also entered into the Merchant Acquiring space beginning September 2018. From SMEs to multinationals, the Bank can now give them the ability to accept debit and credit cards for both POS terminals and E-commerce/Online.

In October 2018, RBank introduced Simplé Savings. This is the Bank’s initiative to tap the unbanked and the underserved segment of the society. With this simplified account opening, there are very minimal requirements and only Php100 needed to open an account.

To further strengthen the footprint in key cities and deliver the products and services of the Bank, it ended 2018 with 162 branches and 291 ATMs nationwide.

Lastly and most importantly, the Bank’s Board of Directors approved on June 27, 2018 the infusion of Php3.0 billion additional capital to support RBank’s growth strategies and to strengthen its capital, liquidity, and leverage requirements in compliance to BSP regulations. On March 18, 2019, the Securities and Exchange Commission granted the Bank regulatory approval for the increase of its authorized capital stock from Php15.0 billion to Php27.0 billion.

Future Business Outlook

For 2019, RBank is programmed to create its next five-year initiative, the Roadmap 2025. This initiative will encapsulate the strategies that the Bank will course through and will define its growth paths to ensure that the Bank will reach its goal of becoming one of the top banks in the country.

The Bank will also continue to implement the business strategies set in the Roadmap 2020 and implement its digital transformation initiatives to provide better customer experience.

The Bank will likewise continue to maximize its potentials to serve as the fifth leg of the JG Summit within the next three years.